Being wealthy is typically perceived as having an abundance of money. However, that is only 1 type of

wealth – Financial Wealth.

There are 4 types of wealth:

Financial Wealth (Money)

Social Wealth (Status)

Time Wealth (Freedom)

Physical Wealth (Health)

Financial Wealth (Money)

Financial Wealth is having an abundance of physical and monetary assets.

Social Wealth (Status)

Social Wealth involves having the resources to fulfil your social needs. It is not necessarily about hierarchy. You can achieve Social Wealth through emotional fulfillment in your relationships.

Time Wealth (Freedom)

Time Wealth is having the freedom to spend your time how you see fit. This means you can allocate where you get the most utility (happiness).

Physical Wealth (Health)

Physical Wealth involves both external and internal health. You can achieve health wealth through physical training (i.e., working out, going for runs), proper nutrition and overall wellbeing.

All 4 types of wealth are correlated. My personal belief is, you can not consider yourself wealthy unless you have balance of all 4.

Where I am able to help on a professional level is helping you build financial wealth, this is my specialty.

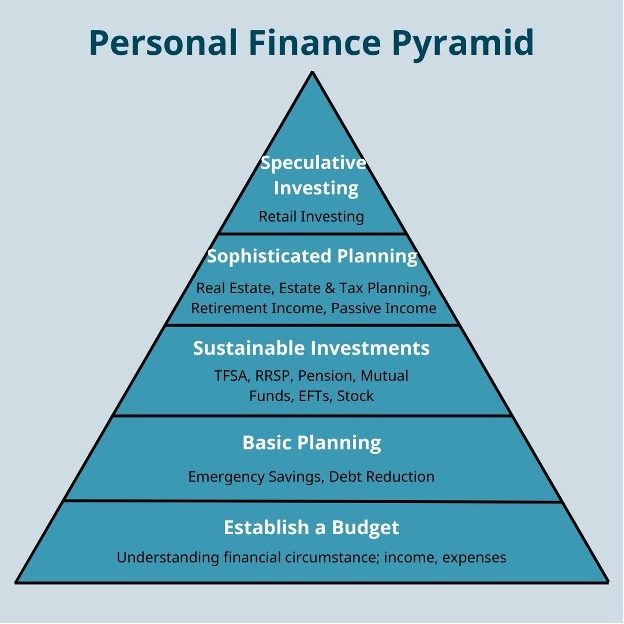

You can build financial wealth by following these steps:

Creating a budget

Removing debt

Starting an Emergency Fund

Investing your money

Creating a Budget

The first step is creating a budget. Creating a budget helps organize your finances. Having the ability to visualize your finances oftentimes helps it become real!

Removing Debt

Next, you want to remove debt. Eliminating debt is an essential component of financial planning and should be your main focus prior to accumulating.

Starting an Emergency Fund

An emergency fund protects you for a rainy day. It is recommended to have 3-6 months of expenses covered in your emergency savings account in case you lose your source of income.

Investing Your Money

After you build an adequate emergency fund, you need to invest your money to make the leap towards financial wealth. Investing is making your money work for you. Through the effect of compound interest, your money will grow exponentially because your money is making money. Investing seems scary because you do not want to risk losing your money. However, over the long term, investing (in professionally managed solutions or Index funds) is considered safe and the biggest risk you take is not taking on any risk at all.

Our self built Personal Finance Pyramid helps illustrate the 5 tiers to building financial wealth.

If you would like to learn more or have any questions, feel free to email or call me anytime or book a meeting by using the following link.

Click Here to book your meeting with Michael Bonomo.