We have seen recent market volatility and it is expected to continue. What does this mean for your long-term portfolio… absolutely nothing!

It is key to remain patient with a long-term picture in mind. Patience requires discipline in order to fulfil your investment goals.

Are Markets

If you answered yes, please keep in mind the following:

One

Market pullbacks are normal – and happen more than you might think

Two

Time IN the market – staying invested ensures you do not miss the best performing days of the market

Expected rates of return over the long-term account for times of market declines. During these times, the best solution is to remain invested, with a long-term picture in mind.

Remember, it’s all about TIME IN the market, NOT TIMING the market.

Staying invested ensures you do not miss the best performing days of the market. Over the last 20 years, missing the 5 best days in the market reduced returns from 173% to 76%… YIKES.

Investing goes beyond the data, it involves psychology. Markets fluctuate everyday and there are time periods where the value of your account will decline. If you panic because of a sudden decline in value of your account, you will ultimately cost yourself money in the short and long term.

If you withdraw money from your account when the value declines, you miss the opportunity to participate in the recovery or uptrend.

It is important to have an investing portfolio that suits your investor profile. Your portfolio should match your timeline, risk tolerance and personal situation. Determining your investor profile is a critical step in investing, I will devote a future article to this subject, which is worthy of its own article.

To put things in perspective, even if you invested at the very top of 2007 before the biggest global recession since the great depression of the 1930’s, you still would have a positive return of almost 200%, as shown in the chart of the S&P500 index below.

The chart in the post shows the long-term growth of the market over time, even with multiple declines. That is why you need patience. Markets are not always going to be up. Patience is required to have the mental toughness to stick it through the good and bad times. You have to weather the storm. Overtime, markets will rebound as proven throughout history.

One way to help remain patient in your investment strategy is to eliminate any ambiguity.

To remove ambiguity in your investment profile is to use a dollar-cost averaging strategy.

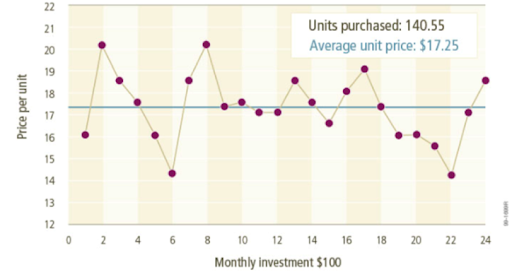

The idea behind dollar-cost averaging is that you buy a fixed amount of whatever you have decided to invest in on a regular schedule. It is a way to be certain you are not buying everything at the highest possible price (WealthSimple, 2018).

Say you have $1000, you can either deposit it as a lump sum all at once, or you can invest $100 monthly for 10 months (dollar cost average). If you look at the chart below, you get a balance of buying in at high and low times to average out because no one can for 100% certainty can time the market.

Patience combined with a steady/consistent approach will allow dollar cost averaging to maximize returns over the long run

Feel free to email or call me anytime with questions or to book a meeting by using the following link.

Click Here to book your meeting with Michael Bonomo.